Full cost markup formula transfer pricing

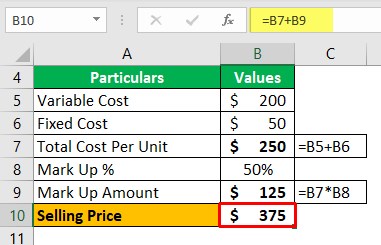

Thus TP COGSx 1 M. Now the formula becomes cost 100 percent markup x 100 selling price.

Everything You Need To Know About Transfer Pricing Incorp Advisory

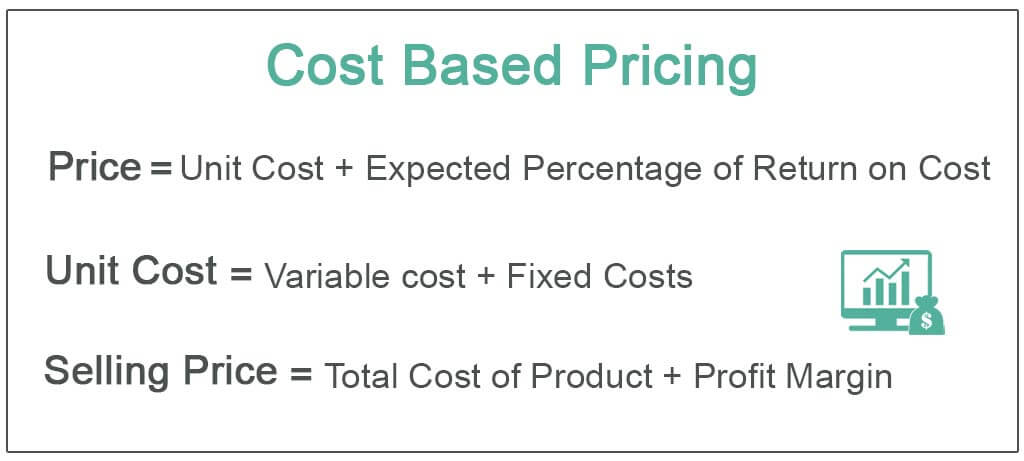

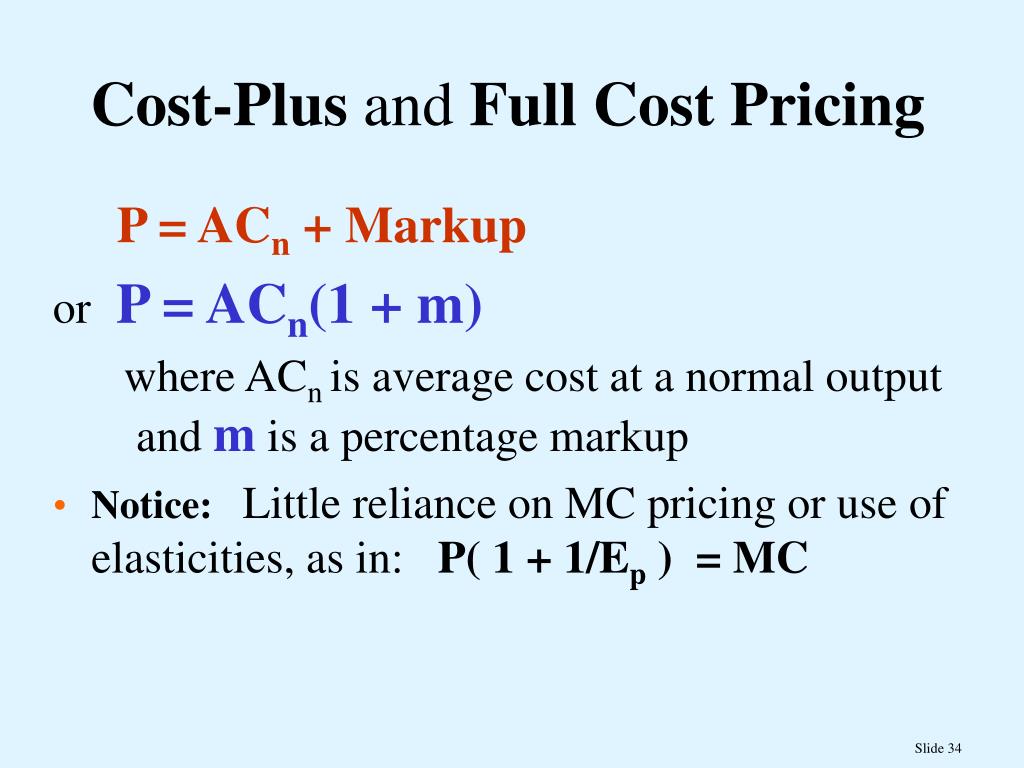

The following is the cost-plus pricing formula.

. Transfer pricing refers to the prices of goods and services that are exchanged between companies under common control. A clothing company reports its production costs as. In order to ensure that the selling division earns a.

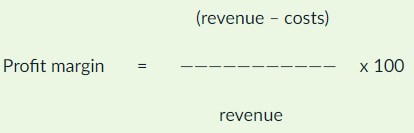

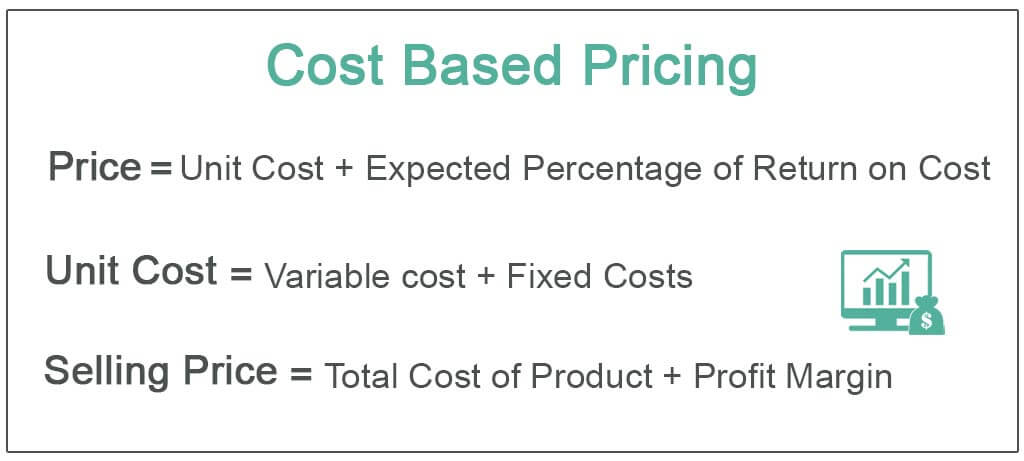

Full-cost pricing is one of many ways for a company to determine the selling price of a product. The full cost-plus markup or profit margin approach compensates for the shortcomings of the full cost basis transfer pricing system. Full cost profit margin.

Total production costs selling and. Determine the unit cost by dividing the aforementioned total cost by the number of units produced. The total cost is the sum of the fixed costs and variable costs.

2500000 Production costs 1000000. Further full cost transfer pricing can provide perverse incentives and distort performance measures. A US-based pen company manufacturing pens.

The full-cost calculation is simple. Typically transfer prices are reflective of. The calculation for setting.

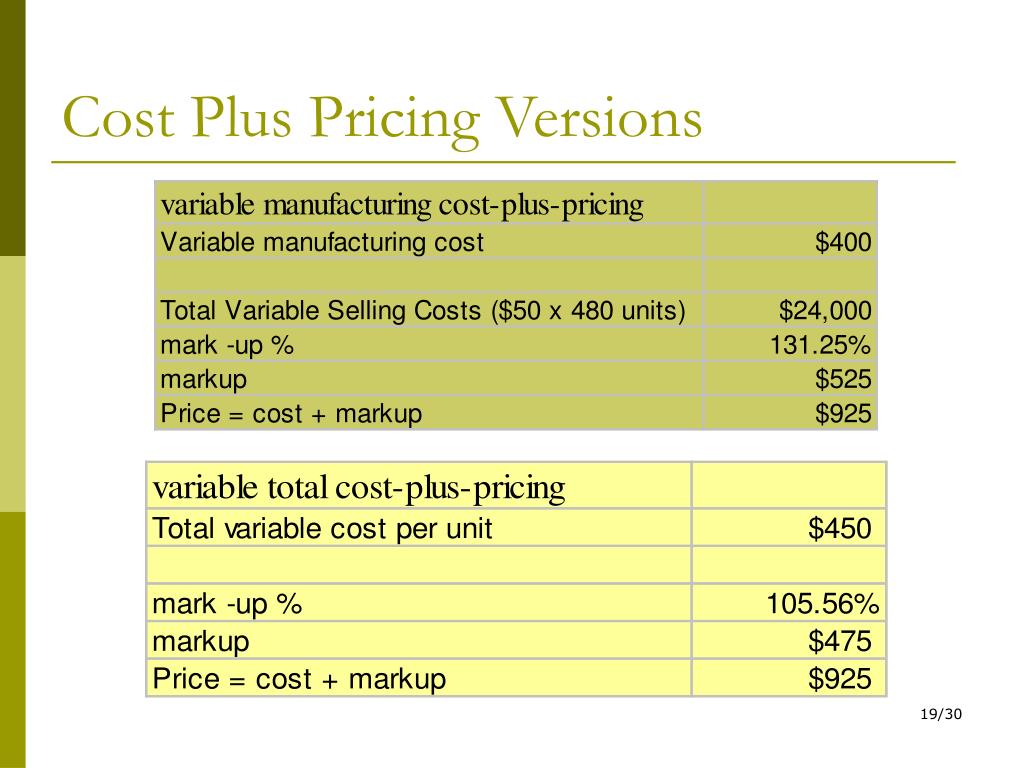

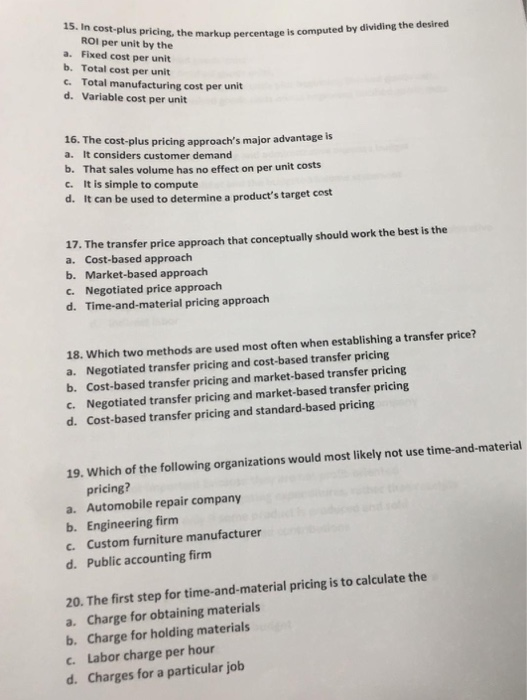

This can be calculated either by simply adding the two divisional profits together 20 20 40 or subtracting both own costs from final revenue 90 30 20 40. A company may set the transfer price at full cost also known as absorption cost which is the sum of variable and fixed costs per unit. Price Cost per unit 1 Percentage markup Lets take an example.

Thus if we formulate the transfer price under Cost Plus Method it would be equal to COGS Markupwhere Markup is arrived by COGS x Markup. The full-cost calculation is simple. O The Arms Length Price for the original transfer of property between the associated enterprises is then given by the difference between the Resale Price and the Gross Margin o Financial Ratio.

A full cost transfer price would have shutdown the chances of any negotiation. For example say a pottery company purchases a vase at wholesale for 50 and needs to sell it. Cost-plus method Under Paragraph 15 of the Regulation this method is applied to the transactions of the seller manufacturer of goods products or provider of services if the.

You then divide this number which should include the price of all units produced by the number of units you expect to sell. A transfer price is used to determine the cost to charge another division subsidiary or holding company for services rendered. Using this method markup is reflected as a percentage by which initial price is set above product cost as reflected in this formula.

For this purpose we define Total Costs Stricto of each company enterprise to be equal to COGS plus XSGA operating expenses before a depreciation deduction which accountants call. Based on this information and using the full cost plus pricing method ABC calculates the following price for its product.

Everything You Need To Know About Transfer Pricing Incorp Advisory

Doc X07 B Responsibility Accounting And Tp Transfer Pricing Jenny Fe Rivera Academia Edu

Ch 10

Ppt Pricing Decisions Powerpoint Presentation Free Download Id 698212

Profit Margin Formula And How To Calculate Lendingtree

Everything You Need To Know About Transfer Pricing Incorp Advisory

Cost Plus Pricing Definition Example Advantage Accountinguide

Cost Based Pricing Definition Formula Top Examples

Ch 10

Everything You Need To Know About Transfer Pricing Incorp Advisory

Everything You Need To Know About Transfer Pricing Incorp Advisory

Ppt Pricing Techniques And Analysis Chapter 14 Powerpoint Presentation Id 3823205

Cost Based Pricing Definition Formula Top Examples

Solved 15 In Cost Plus Pricing The Markup Percentage Is Chegg Com

Insight Unbundling Your Way Out Of Beat Can Cost Allocations Make A Difference

Learn About Markup Chegg Com

Everything You Need To Know About Transfer Pricing Incorp Advisory